Indicators on Financial Advisor Magazine You Should Know

Wiki Article

Get This Report about Financial Advisor Salary

Table of Contents8 Simple Techniques For Financial Advisor JobsThe 25-Second Trick For Financial Advisor Near MeThe 2-Minute Rule for Financial Advisor JobsAll about Financial Advisor Job Description

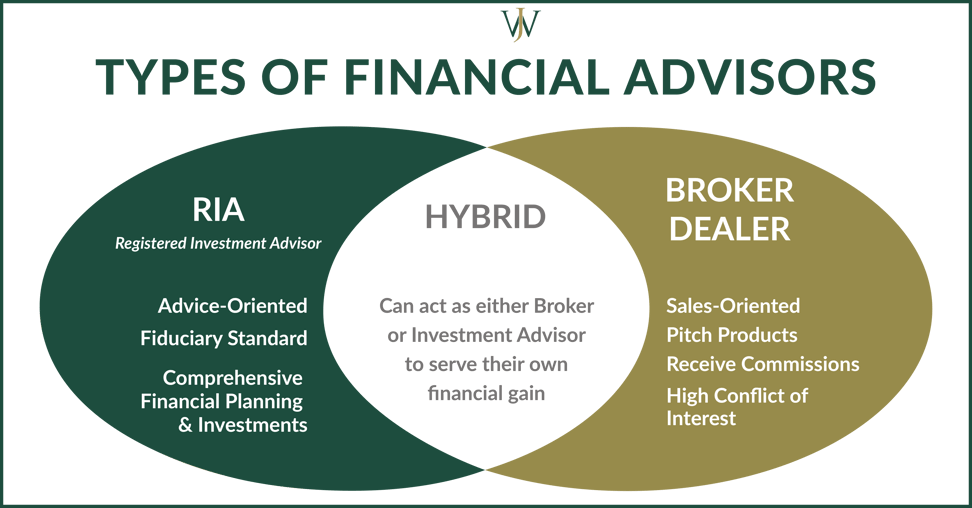

There are several sorts of economic advisors out there, each with differing qualifications, specialties, and also degrees of accountability. And when you're on the quest for a professional suited to your needs, it's not uncommon to ask, "Just how do I know which economic advisor is best for me?" The answer begins with an honest bookkeeping of your needs and a bit of research study.Types of Financial Advisors to Consider Depending on your financial needs, you might choose for a generalized or specialized financial consultant. As you begin to dive right into the world of looking for out a monetary advisor that fits your requirements, you will likely be presented with several titles leaving you asking yourself if you are getting in touch with the ideal individual.

It is crucial to keep in mind that some monetary experts additionally have broker licenses (meaning they can sell safety and securities), yet they are not entirely brokers. On the very same note, brokers are not all licensed similarly as well as are not monetary consultants. This is simply one of the numerous factors it is best to start with a certified financial organizer who can suggest you on your financial investments and also retired life.

Some Known Factual Statements About Financial Advisor Job Description

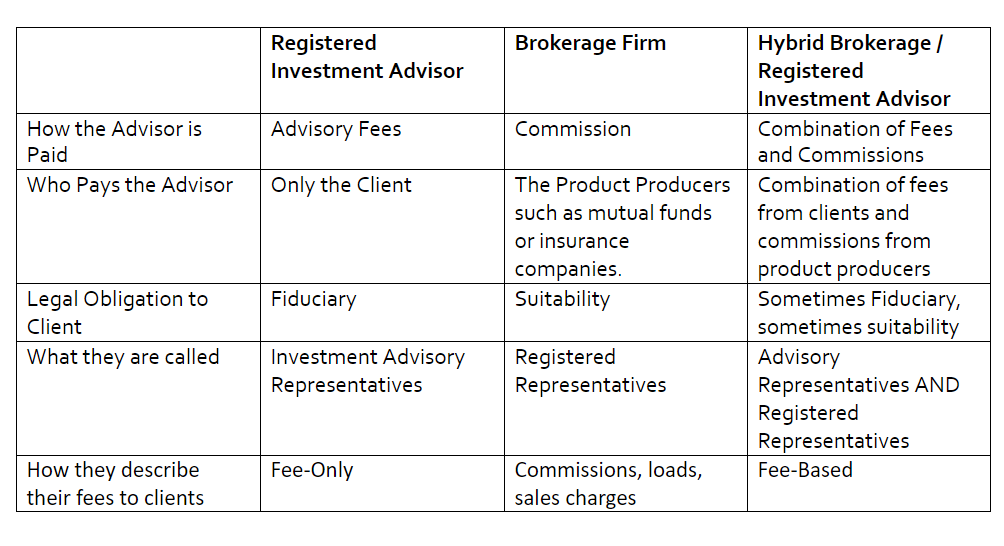

Unlike investment experts, brokers are not paid directly by customers, instead, they make compensations for trading supplies and bonds, as well as for offering mutual funds and also other products.

A recognized estate coordinator (AEP) is an expert who specializes in estate preparation. When you're looking for a monetary expert, it's good to have an idea what you want help with.

A lot financial advisor auckland like "economic expert," "monetary organizer" is also a wide term. No matter of your specific needs and also economic circumstance, one criteria you must strongly consider is whether a potential consultant is a fiduciary.

Getting My Financial Advisor Ratings To Work

To safeguard on your own from a person who is simply attempting to get more cash from you, it's a great concept to seek an expert who is registered as a fiduciary. A financial expert that is signed up as a fiduciary is needed, by legislation, to act in the best interests of a customer.Fiduciaries can just recommend you to make use of such items if they believe it's in fact the very best economic choice for you to do so. The U.S. Stocks and also Exchange Compensation (SEC) regulates fiduciaries. Fiduciaries that fall short to act in a client's ideal passions could be struck with fines and/or jail time of up to 10 years.

Nonetheless, that isn't due to the fact that any individual can get them. Receiving either accreditation calls for somebody to experience a selection of classes as well as examinations, in enhancement to gaining a collection quantity of hands-on experience. The outcome of the certification procedure is that CFPs as well as Ch, FCs are Check This Out fluent in subjects throughout the field of individual money.

For instance, the charge might be 1. 5% for AUM between $0 and $1 million, yet 1% for all properties over $1 million. Fees usually decrease as AUM increases. An expert that generates income entirely from this monitoring cost is a fee-only consultant. The option is a fee-based expert. They seem similar, but there's an essential difference.

The Only Guide for Financial Advisor Near Me

A consultant's monitoring charge might or might not cover the costs associated with trading safeties. Some advisors likewise bill a get more set charge per transaction.

This is a solution where the advisor will bundle all account administration costs, consisting of trading costs as well as expense proportions, right into one extensive fee. Due to the fact that this cost covers a lot more, it is usually greater than a charge that just consists of management and also leaves out things like trading prices. Cover costs are appealing for their simpleness yet also aren't worth the cost for every person.

While a conventional consultant generally bills a cost in between 1% as well as 2% of AUM, the fee for a robo-advisor is normally 0. The big compromise with a robo-advisor is that you frequently don't have the capability to talk with a human expert.

Report this wiki page